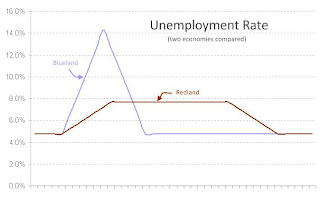

Are "Soft Landings" really softer?

Falling off a roof, I'd rather have a soft landing than a hard one; but, does the metaphor translate to economies? Example: Imagine two countries -- Redland and Blueland -- both with unemployment around 5%. Next, imagine unemployment shoots up to 14% in " Blueland " while " Redland " has a far milder rise to 8%. However, the rate of unemployment comes back to 5% much sooner in Blueland, while it lingers at a 8% for a while in Redland. Is there any reason to think Redland is better off in this example? Even if we accept the notion that governments can and may engineer a soft-landing, it is far from clear that a shallower recession is a good thing, if it means extending its duration . Think of individuals: Would you rather be unemployed for 1 year or for 3 years? It's a no-brainer! A laid-off dad from my son's school told me his savings could last him six months before he starts getting desperate. For him, a short sharp downturn would