Where did all the stimulus go... (When will they ever learn?)

In Jan 2009, proposing almost $1 trillion in new spending, President-elect Obama said: "...at this particular moment, only government can provide the short-term boost necessary to lift us from a recession this deep and severe. Only government can break the vicious cycles that are crippling our economy..."

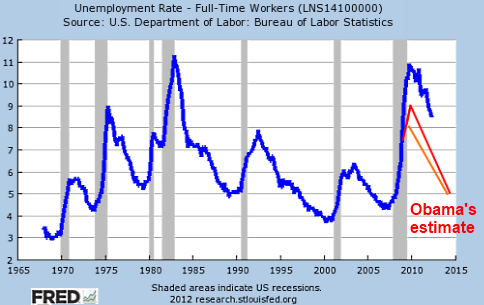

Obama's team released expectations of the unemployment rate with and without the stimulus. Their prediction for the unemployment rate at the end of Obama's term with and without the stimulus, was -- drum roll -- 5.2% as against 5.5%! They also predicted that by 2014, we'll be about the same with or without the stimulus. Here are the options they offered us, using their figures and assumptions, not mine:

Of course, Obama will argue the counter-factual: if we had not borrowed and spent a couple of trillion, things would have been worse; but...

History shows otherwise: The most famous example of public works in the U.S. was Roosevelt's various programs. So, let's turn to Henry Morgenthau Jr., Roosevelt's Treasury Secy. from 1934 to 1945. Even though he was not fully sold on the New Deal, he was a loyal friend to Roosevelt. Speaking at a private meeting in 1939, Morgenthau said: "We have tried spending money. We have spent more than we have ever spent before, and it does not work. We have never made good on our promises. I say, after 8 years of this administration, we have just as much unemployment as when we started, and an enormous debt to boot."

Finally, a cartoon can sometimes speak better than words. [Hat tip: Not PC]

Notes: Morgenthau quote, from Burton Folsom

- without stimulus, (red line) unemployment will rise to 9% and go down slowly to 5% by 2014

- with stimulus (orange line), unemployment will rise to 8% and go down much faster reaching 5% by 2014

Of course, Obama will argue the counter-factual: if we had not borrowed and spent a couple of trillion, things would have been worse; but...

History shows otherwise: The most famous example of public works in the U.S. was Roosevelt's various programs. So, let's turn to Henry Morgenthau Jr., Roosevelt's Treasury Secy. from 1934 to 1945. Even though he was not fully sold on the New Deal, he was a loyal friend to Roosevelt. Speaking at a private meeting in 1939, Morgenthau said: "We have tried spending money. We have spent more than we have ever spent before, and it does not work. We have never made good on our promises. I say, after 8 years of this administration, we have just as much unemployment as when we started, and an enormous debt to boot."

Despite the historical evidence, Keynesianism refuses to die. As investment manager Jeremy Grantham says "...never underestimate the unwillingness of academics to change their views in the face of evidence".

Finally, a cartoon can sometimes speak better than words. [Hat tip: Not PC]

Notes: Morgenthau quote, from Burton Folsom

Comments

Post a Comment