How're we doing? (A review of 2013)

Overview: Slow economy, rocketing stock market! Since the 2007-08 downturn, most measures of the economy have stabilized. Despite this, total-employment is still lower. The broadest GDP measure has been increasing very slowly. Meanwhile, house-prices have turned up for the last two years, and the stock market is at an all-time high.

Corporate profits are high since GDP is growing slowly while firms have kept a reign on costs. In addition, companies have been buying back stock at above-average levels. This is different from the type of excitement that drove the dot.com boom, because it does not cascade into higher salaries and expenditures: quite the opposite. In the short/medium term, this does not bode well for employment numbers and wages.

Here are some of the details:

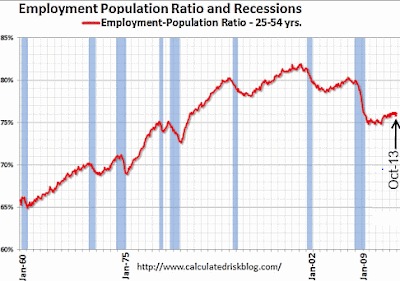

Employment: Though the unemployment rate has been falling, it is mainly because so many people (particularly younger folk) have given up looking for jobs. For the core age-range 25-54 years, employment % is flat.

Employment: Though the unemployment rate has been falling, it is mainly because so many people (particularly younger folk) have given up looking for jobs. For the core age-range 25-54 years, employment % is flat.

(BLS has latest data)

Real GDP: Real GDP picked up after pausing for about a year. It is growing slower than before, with people like Bill Gross of PIMCO saying we're in a "new normal". The graph is from the FRED database. The Y axis uses a log-scale, to make it easier to see growth rates. I have added hand-drawn, rough (by eye) "trend lines". Real GDP has grown steadily after each recession, but the rate has slowed a few times. With that said, the current trend is not long enough to tell; see how it was similarly slow in the late 1970s.

Real GDP: Real GDP picked up after pausing for about a year. It is growing slower than before, with people like Bill Gross of PIMCO saying we're in a "new normal". The graph is from the FRED database. The Y axis uses a log-scale, to make it easier to see growth rates. I have added hand-drawn, rough (by eye) "trend lines". Real GDP has grown steadily after each recession, but the rate has slowed a few times. With that said, the current trend is not long enough to tell; see how it was similarly slow in the late 1970s.

Here is a per capita version: The flattening is clear.

Retail Sales: Have resumed their pre-recession pace. A flat first half of 2012 now looks like an inconspicuous blip.

Home prices:

The Case-Schiller index has been rising for two years now.

Price-rise: The CPI has stayed relatively low -- under 2% for the last year. Using the TIPS to calculate the market's "expected inflation" shows it is under 2% going out 10 years, reaching 2% only 30 years from now!

Summary: There is no enthusiasm about the economy. The Christmas season might improve on last year, but it is unlikely to be great. Consequently, companies are unlikely to raise hiring or wages much more than they've been doing. Government entities aren't likely to go gang-busters either. At the Federal level, even without another debt-limit stand-off, we will probably not see a new fiscal splurge. So, "new normal" seems appropriate.

Even though the stock-market is booming, it is without excitement: more like "there's no other game in town, while the FED keeps rates low; and, profits are high through cost-control". The divergence cannot go on forever, but it can resolve itself in various ways. Much of the market-sentiment is driven by what John Hussman calls "superstition" about the Fed's ability to keep this playing out for a many more years.

I still think a new downturn is very likely before Obama's term ends. Let's see.

Corporate profits are high since GDP is growing slowly while firms have kept a reign on costs. In addition, companies have been buying back stock at above-average levels. This is different from the type of excitement that drove the dot.com boom, because it does not cascade into higher salaries and expenditures: quite the opposite. In the short/medium term, this does not bode well for employment numbers and wages.

Here are some of the details:

Employment: Though the unemployment rate has been falling, it is mainly because so many people (particularly younger folk) have given up looking for jobs. For the core age-range 25-54 years, employment % is flat.

Employment: Though the unemployment rate has been falling, it is mainly because so many people (particularly younger folk) have given up looking for jobs. For the core age-range 25-54 years, employment % is flat.(BLS has latest data)

Real GDP: Real GDP picked up after pausing for about a year. It is growing slower than before, with people like Bill Gross of PIMCO saying we're in a "new normal". The graph is from the FRED database. The Y axis uses a log-scale, to make it easier to see growth rates. I have added hand-drawn, rough (by eye) "trend lines". Real GDP has grown steadily after each recession, but the rate has slowed a few times. With that said, the current trend is not long enough to tell; see how it was similarly slow in the late 1970s.

Real GDP: Real GDP picked up after pausing for about a year. It is growing slower than before, with people like Bill Gross of PIMCO saying we're in a "new normal". The graph is from the FRED database. The Y axis uses a log-scale, to make it easier to see growth rates. I have added hand-drawn, rough (by eye) "trend lines". Real GDP has grown steadily after each recession, but the rate has slowed a few times. With that said, the current trend is not long enough to tell; see how it was similarly slow in the late 1970s.Here is a per capita version: The flattening is clear.

Retail Sales: Have resumed their pre-recession pace. A flat first half of 2012 now looks like an inconspicuous blip.

Home prices:

The Case-Schiller index has been rising for two years now.

Price-rise: The CPI has stayed relatively low -- under 2% for the last year. Using the TIPS to calculate the market's "expected inflation" shows it is under 2% going out 10 years, reaching 2% only 30 years from now!

Summary: There is no enthusiasm about the economy. The Christmas season might improve on last year, but it is unlikely to be great. Consequently, companies are unlikely to raise hiring or wages much more than they've been doing. Government entities aren't likely to go gang-busters either. At the Federal level, even without another debt-limit stand-off, we will probably not see a new fiscal splurge. So, "new normal" seems appropriate.

Even though the stock-market is booming, it is without excitement: more like "there's no other game in town, while the FED keeps rates low; and, profits are high through cost-control". The divergence cannot go on forever, but it can resolve itself in various ways. Much of the market-sentiment is driven by what John Hussman calls "superstition" about the Fed's ability to keep this playing out for a many more years.

I still think a new downturn is very likely before Obama's term ends. Let's see.

Comments

Post a Comment